Multiple Choice

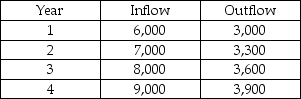

Lisa is pondering the construction and operation of a home-based cattery. She expects it will cost $35,000 to construct and will have a lifespan of four years before it collapses due to faulty construction and ammonia rot. Cash flows during those four glorious years are estimated as follows:

If the interest rate is 5%, what is the present value of the cattery project?

A) -18,800

B) -20,790

C) -26,378

D) -47,168

Correct Answer:

Verified

Correct Answer:

Verified

Q45: The present value factors found in Table

Q46: Since 1986, the only acceptable accelerated depreciation

Q47: The _ is used to evaluate projects

Q48: Conhugeco's CEO is ready to step down

Q49: An investor puts $10,000 in an account

Q50: The present value of an investment is

Q51: Discounting is the process by which interest

Q52: To calculate straight-line depreciation, you divide the

Q53: Depreciation is not a legitimate cash flow.

Q54: The amount that must be invested now