Multiple Choice

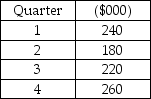

John Owen owns a drugstore that is experiencing significant growth. Owen is trying to decide whether to expand its capacity, which currently is $200,000 in sales per quarter. Sales are seasonal. Forecasts of capacity requirements, expressed in sales per quarter for the next year, follow.

Owen is considering expanding capacity to the $250,000 level in sales per quarter. The before-tax profit margin from additional sales is 15 percent. How much would before-tax profits increase next year because of this expansion?

A) less than $15,000

B) more than $15,000 but less than $16,000

C) more than $16,000 but less than $17,000

D) more than $17,000

Correct Answer:

Verified

Correct Answer:

Verified

Q32: Capacity decisions should be linked closely to

Q33: George P. Burdell owns a hot tub

Q34: Diseconomies of scale is a concept that

Q35: Discuss the relationship between setup time and

Q36: A standard work year is 2,080 hours

Q38: Give four principal reasons economies of scale

Q39: Large, infrequent jumps in capacity are characteristic

Q40: Capacity cushions may be lowered if companies

Q41: Figure 4.1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB1252/.jpg" alt="Figure 4.1

Q42: _ occurs when the average cost per