Multiple Choice

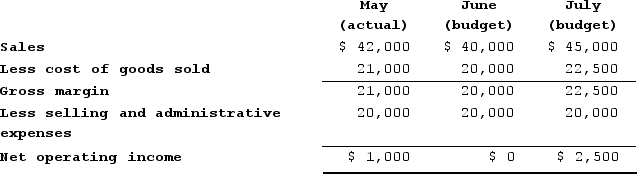

KAB Incorporated, a small retail store, had the following results for May. The budgets for June and July are also given.  Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.The cash disbursements during June for goods purchased for sale and for selling and administrative expenses should be:

Sales are collected 80% in the month of the sale and the balance in the month following the sale. (There are no bad debts.) The goods that are sold are purchased in the month prior to sale. Suppliers of the goods are paid in the month following the sale. The "selling and administrative expenses" are paid in the month of the sale.The cash disbursements during June for goods purchased for sale and for selling and administrative expenses should be:

A) $40,000

B) $41,000

C) $42,500

D) $43,500

Correct Answer:

Verified

Correct Answer:

Verified

Q90: Smith Corporation makes and sells a single

Q91: Sioux Corporation is estimating the following sales

Q92: Carver Lumber sells lumber and general building

Q93: Catano Corporation pays for 40% of its

Q94: Dilly Farm Supply is located in a

Q96: Capes Corporation is a wholesaler of industrial

Q97: Davis Corporation is preparing its Manufacturing Overhead

Q98: Carver Lumber sells lumber and general building

Q99: Petrini Corporation makes one product and it

Q100: LBC Corporation makes and sells a product