Multiple Choice

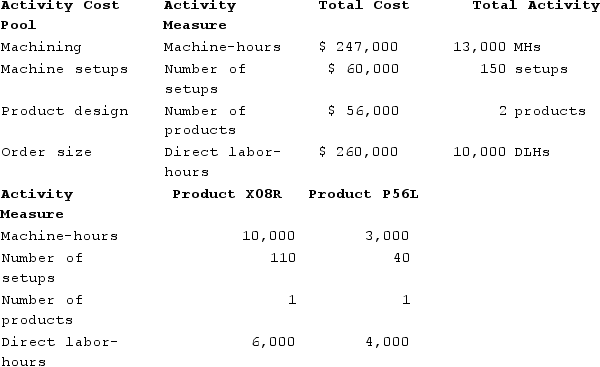

Bippus Corporation manufactures two products: Product X08R and Product P56L. The company uses a plantwide overhead rate based on direct labor-hours. It is considering implementing an activity-based costing (ABC) system that allocates its manufacturing overhead to four cost pools. The following additional information is available for the company as a whole and for Products X08R and P56L.  Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product P56L?

Using the plantwide overhead rate, how much manufacturing overhead cost would be allocated to Product P56L?

A) $311,500

B) $373,800

C) $249,200

D) $418,000

Correct Answer:

Verified

Correct Answer:

Verified

Q38: Deemer Corporation has an activity-based costing system

Q39: Doles Corporation uses the following activity rates

Q40: Foster Florist specializes in large floral bouquets

Q41: Deninno Corporation is conducting a time-driven activity-based

Q42: Delauder Enterprises makes a variety of products

Q44: Flemming Corporation uses activity-based costing to compute

Q45: Mustafa Enterprises makes a variety of products

Q46: Data concerning three of Kilmon Corporation's activity

Q47: Cieslinski Corporation is conducting a time-driven activity-based

Q48: Zwahlen Corporation has an activity-based costing system