Multiple Choice

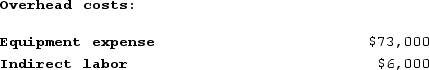

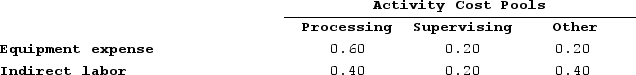

Deemer Corporation has an activity-based costing system with three activity cost pools--Processing, Supervising, and Other. In the first stage allocations, costs in the two overhead accounts, equipment expense and indirect labor, are allocated to the three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

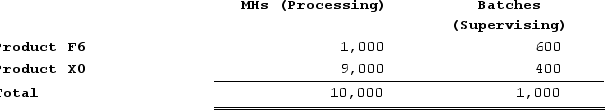

Distribution of Resource Consumption Across Activity Cost Pools: Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

How much overhead cost is allocated to the Supervising activity cost pool under activity-based costing?

A) $15,800

B) $1,200

C) $17,000

D) $14,600

Correct Answer:

Verified

Correct Answer:

Verified

Q33: Horgen Corporation manufactures two products: Product M68B

Q34: Fleisher Corporation is conducting a time-driven activity-based

Q35: An activity-based costing system that is designed

Q36: Organization-sustaining activities relate to specific customers and

Q37: Delauder Enterprises makes a variety of products

Q39: Doles Corporation uses the following activity rates

Q40: Foster Florist specializes in large floral bouquets

Q41: Deninno Corporation is conducting a time-driven activity-based

Q42: Delauder Enterprises makes a variety of products

Q43: Bippus Corporation manufactures two products: Product X08R