Multiple Choice

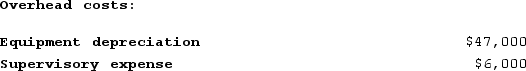

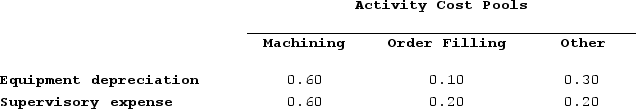

Lysiak Corporation uses an activity based costing system to assign overhead costs to products. In the first stage, two overhead costs--equipment depreciation and supervisory expense-are allocated to three activity cost pools--Machining, Order Filling, and Other--based on resource consumption. Data to perform these allocations appear below:  Distribution of Resource Consumption Across Activity Cost Pools:

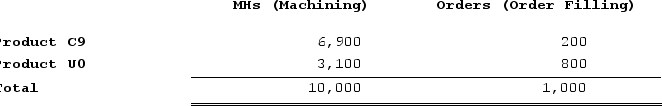

Distribution of Resource Consumption Across Activity Cost Pools: In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

In the second stage, Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product C9 under activity-based costing?

What is the overhead cost assigned to Product C9 under activity-based costing?

A) $26,500

B) $21,942

C) $1,180

D) $23,122

Correct Answer:

Verified

Correct Answer:

Verified

Q371: Desilets Corporation has provided the following data

Q372: Hails Corporation manufactures two products: Product Q21F

Q373: Stapel Corporation is conducting a time-driven activity-based

Q374: Mirabile Corporation uses activity-based costing to compute

Q375: Howell Corporation's activity-based costing system has three

Q377: Desjarlais Corporation uses the following activity rates

Q378: Eccles Corporation uses an activity-based costing system

Q379: Angara Corporation uses activity-based costing to determine

Q380: Greife Corporation's activity-based costing system has three

Q381: Deemer Corporation has an activity-based costing system