Essay

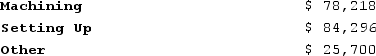

Greife Corporation's activity-based costing system has three activity cost pools--Machining, Setting Up, and Other. The company's overhead costs have already been allocated to these cost pools as follows:

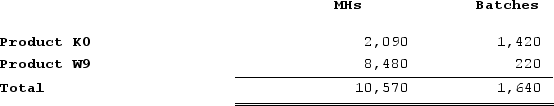

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

Costs in the Machining cost pool are assigned to products based on machine-hours (MHs) and costs in the Setting Up cost pool are assigned to products based on the number of batches. Costs in the Other cost pool are not assigned to products. The following table shows the machine-hours and number of batches associated with each of the company's two products:

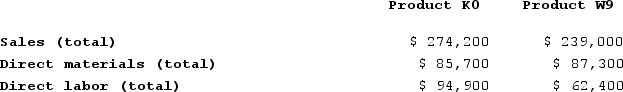

Additional data concerning the company's products appears below:

Additional data concerning the company's products appears below:

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers to 2 decimal places.) b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. (Round intermediate calculations to 2 decimal places.) c. Determine the product margins for each product using activity-based costing. (Round intermediate calculations to 2 decimal places.)

Required:a. Calculate activity rates for each activity cost pool using activity-based costing. (Round your answers to 2 decimal places.) b. Determine the amount of overhead cost that would be assigned to each product using activity-based costing. (Round intermediate calculations to 2 decimal places.) c. Determine the product margins for each product using activity-based costing. (Round intermediate calculations to 2 decimal places.)

Correct Answer:

Verified

a. Computation of activity rat...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q372: Hails Corporation manufactures two products: Product Q21F

Q373: Stapel Corporation is conducting a time-driven activity-based

Q374: Mirabile Corporation uses activity-based costing to compute

Q375: Howell Corporation's activity-based costing system has three

Q376: Lysiak Corporation uses an activity based costing

Q377: Desjarlais Corporation uses the following activity rates

Q378: Eccles Corporation uses an activity-based costing system

Q379: Angara Corporation uses activity-based costing to determine

Q381: Deemer Corporation has an activity-based costing system

Q382: Callum Corporation is conducting a time-driven activity-based