Multiple Choice

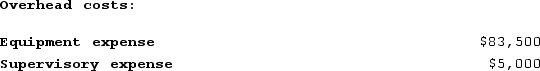

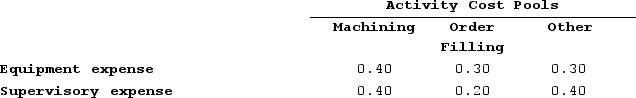

Meester Corporation has an activity-based costing system with three activity cost pools--Machining, Order Filling, and Other. In the first stage allocations, costs in the two overhead accounts, equipment depreciation and supervisory expense, are allocated to three activity cost pools based on resource consumption. Data used in the first stage allocations follow:  Distribution of Resource Consumption Across Activity Cost Pools:

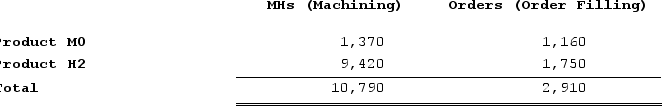

Distribution of Resource Consumption Across Activity Cost Pools: Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity:

Machining costs are assigned to products using machine-hours (MHs) and Order Filling costs are assigned to products using the number of orders. The costs in the Other activity cost pool are not assigned to products. Activity data for the company's two products follow:Activity: What is the overhead cost assigned to Product H2 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

What is the overhead cost assigned to Product H2 under activity-based costing? (Round your intermediate calculations to 2 decimal places.)

A) $30,898

B) $15,663

C) $46,560

D) $60,450

Correct Answer:

Verified

Correct Answer:

Verified

Q216: Younan Corporation manufactures two products: Product E47F

Q217: When switching from a traditional costing system

Q218: Mirabile Corporation uses activity-based costing to compute

Q219: Reck Corporation uses activity-based costing to assign

Q220: Handal Corporation uses activity-based costing to compute

Q222: Villella Corporation is conducting a time-driven activity-based

Q223: Feldpausch Corporation has provided the following data

Q224: Salem Corporation is conducting a time-driven activity-based

Q225: Weimar Corporation is conducting a time-driven activity-based

Q226: Meester Corporation has an activity-based costing system