Multiple Choice

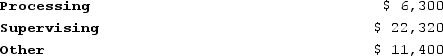

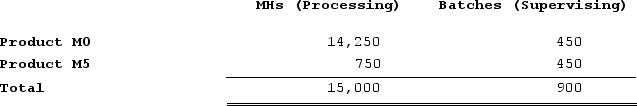

Mirabile Corporation uses activity-based costing to compute product margins. Overhead costs have already been allocated to the company's three activity cost pools--Processing, Supervising, and Other. The costs in those activity cost pools appear below:  Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below:

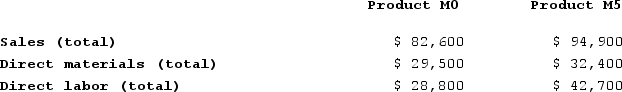

Processing costs are assigned to products using machine-hours (MHs) and Supervising costs are assigned to products using the number of batches. The costs in the Other activity cost pool are not assigned to products. Activity data appear below: Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins.

Finally, sales and direct cost data are combined with Processing and Supervising costs to determine product margins. The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

The activity rate for the Supervising activity cost pool under activity-based costing is closest to:

A) $37.47 per batch

B) $31.80 per batch

C) $24.80 per batch

D) $14.00 per batch

Correct Answer:

Verified

Correct Answer:

Verified

Q213: Desjarlais Corporation uses the following activity rates

Q214: Departmental overhead rates will correctly assign overhead

Q215: Groleau Corporation has an activity-based costing system

Q216: Younan Corporation manufactures two products: Product E47F

Q217: When switching from a traditional costing system

Q219: Reck Corporation uses activity-based costing to assign

Q220: Handal Corporation uses activity-based costing to compute

Q221: Meester Corporation has an activity-based costing system

Q222: Villella Corporation is conducting a time-driven activity-based

Q223: Feldpausch Corporation has provided the following data