Multiple Choice

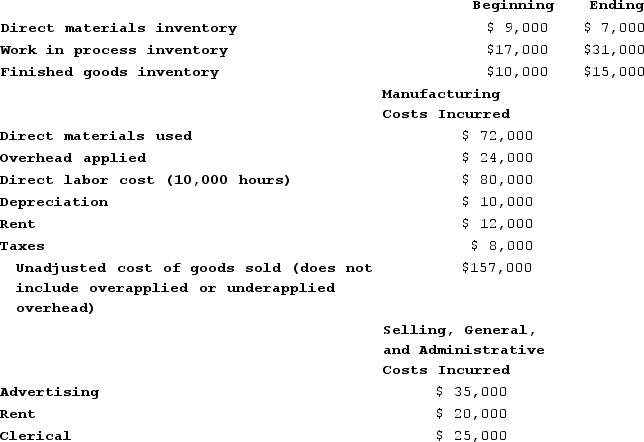

The accounting records of Omar Corporation contained the following information for last year:  If Omar Corporation applies overhead to jobs on the basis of direct labor-hours and Job 3 took 120 hours, how much overhead should be applied to that job?

If Omar Corporation applies overhead to jobs on the basis of direct labor-hours and Job 3 took 120 hours, how much overhead should be applied to that job?

A) $960

B) $360

C) $528

D) $288

Correct Answer:

Verified

Correct Answer:

Verified

Q12: Tevebaugh Corporation is a manufacturer that uses

Q13: Matthias Corporation has provided data concerning the

Q14: During March, Zea Incorporated transferred $55,000 from

Q15: The following partially completed T-accounts are for

Q16: During December, Moulding Corporation incurred $87,000 of

Q18: Reith Incorporated has provided the following data

Q19: Caple Corporation applies manufacturing overhead on the

Q20: Entry (11) in the below T-account could

Q21: Caple Corporation applies manufacturing overhead on the

Q22: Dacosta Corporation had only one job in