Multiple Choice

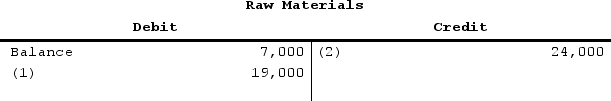

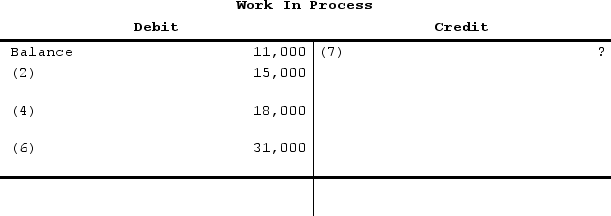

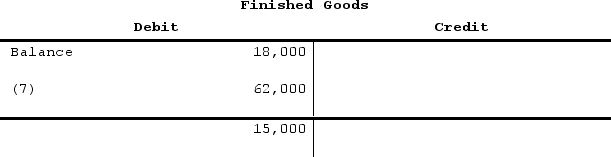

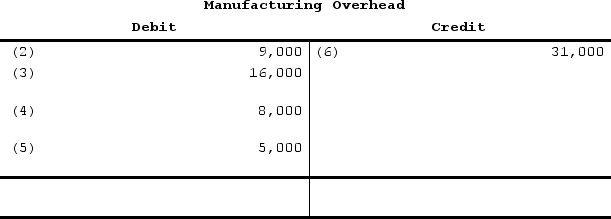

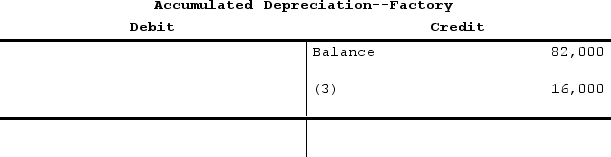

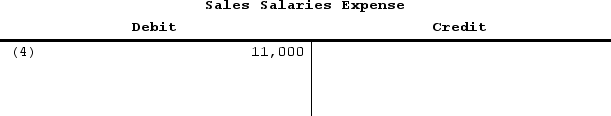

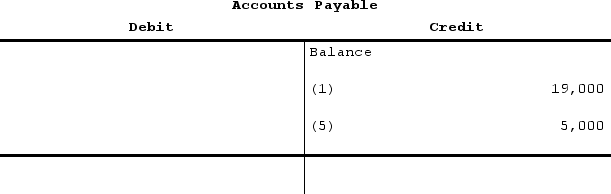

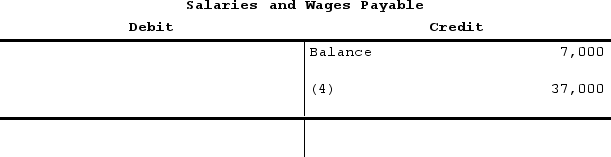

The following partially completed T-accounts are for Stanford Corporation:

The indirect labor cost is:

The indirect labor cost is:

A) $8,000

B) $15,000

C) $18,000

D) $37,000

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Baka Corporation applies manufacturing overhead on the

Q11: If the actual manufacturing overhead cost for

Q12: Tevebaugh Corporation is a manufacturer that uses

Q13: Matthias Corporation has provided data concerning the

Q14: During March, Zea Incorporated transferred $55,000 from

Q16: During December, Moulding Corporation incurred $87,000 of

Q17: The accounting records of Omar Corporation contained

Q18: Reith Incorporated has provided the following data

Q19: Caple Corporation applies manufacturing overhead on the

Q20: Entry (11) in the below T-account could