Multiple Choice

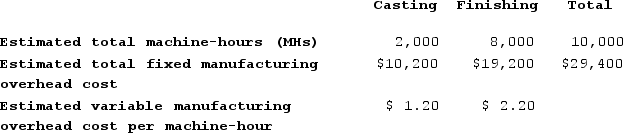

Lotz Corporation has two manufacturing departments--Casting and Finishing. The company used the following data at the beginning of the year to calculate predetermined overhead rates:  During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow:

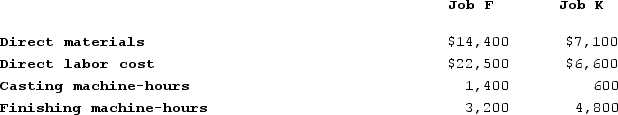

During the most recent month, the company started and completed two jobs--Job F and Job K. There were no beginning inventories. Data concerning those two jobs follow: Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job F is closest to: (Round your intermediate calculations to 2 decimal places.)

Assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both production departments. Further assume that the company uses a markup of 50% on manufacturing cost to establish selling prices. The calculated selling price for Job F is closest to: (Round your intermediate calculations to 2 decimal places.)

A) $30,220

B) $90,660

C) $60,440

D) $96,100

Correct Answer:

Verified

Correct Answer:

Verified

Q79: Merati Corporation has two manufacturing departments--Forming and

Q80: Placker Corporation uses a job-order costing system

Q81: Molash Corporation has two manufacturing departments--Machining and

Q82: Moscone Corporation bases its predetermined overhead rate

Q83: The fact that one department may be

Q85: Marius Corporation has two production departments, Casting

Q86: In a job-order cost system, indirect labor

Q87: Adelberg Corporation makes two products: Product A

Q88: Bierce Corporation has two manufacturing departments--Machining and

Q89: The management of Garn Corporation would like