Multiple Choice

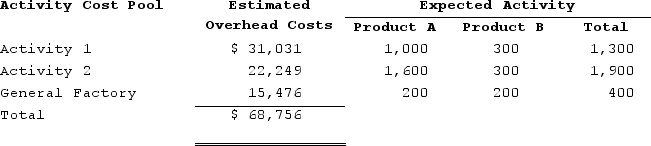

Adelberg Corporation makes two products: Product A and Product B. Annual production and sales are 500 units of Product A and 1,000 units of Product B. The company has traditionally used direct labor-hours as the basis for applying all manufacturing overhead to products. Product A requires 0.4 direct labor-hours per unit and Product B requires 0.2 direct labor-hours per unit. The total estimated overhead for next period is $68,756.The company is considering switching to an activity-based costing system for the purpose of computing unit product costs for external reports. The new activity-based costing system would have three overhead activity cost pools--Activity 1, Activity 2, and General Factory--with estimated overhead costs and expected activity as follows:  (Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

(Note: The General Factory activity cost pool's costs are allocated on the basis of direct labor-hours.)

The overhead cost per unit of Product B under the activity-based costing system is closest to:

A) $45.84

B) $7.74

C) $34.38

D) $18.41

Correct Answer:

Verified

Correct Answer:

Verified

Q82: Moscone Corporation bases its predetermined overhead rate

Q83: The fact that one department may be

Q84: Lotz Corporation has two manufacturing departments--Casting and

Q85: Marius Corporation has two production departments, Casting

Q86: In a job-order cost system, indirect labor

Q88: Bierce Corporation has two manufacturing departments--Machining and

Q89: The management of Garn Corporation would like

Q90: Ahlheim Corporation has two production departments, Forming

Q91: Lueckenhoff Corporation uses a job-order costing system

Q92: In a job-order costing system, costs are