Multiple Choice

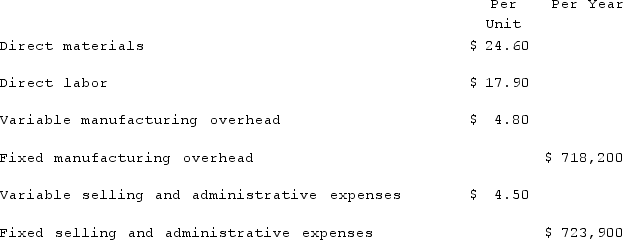

Kirgan, Inc., manufactures a product with the following costs:  The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 57,000 units per year.The company has invested $140,000 in this product and expects a return on investment of 13%.The selling price based on the absorption costing approach would be closest to:

The company uses the absorption costing approach to cost-plus pricing described in the text. The pricing calculations are based on budgeted production and sales of 57,000 units per year.The company has invested $140,000 in this product and expects a return on investment of 13%.The selling price based on the absorption costing approach would be closest to:

A) $77.42

B) $99.65

C) $77.10

D) $61.13

Correct Answer:

Verified

Correct Answer:

Verified

Q275: Twisdale Corporation manufactures numerous products, one of

Q276: Milford Corporation has in stock 16,100 kilograms

Q277: The management of Giammarino Corporation is considering

Q278: Key Corporation is considering the addition of

Q279: The management of Furrow Corporation is considering

Q281: Supler Corporation produces a part used in

Q282: A disadvantage of vertical integration is that

Q283: The management of Wengel Corporation is considering

Q284: Ibsen Company makes two products from a

Q285: Fixed costs are sunk costs.