Essay

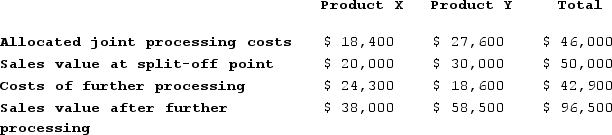

Ibsen Company makes two products from a common input. Joint processing costs up to the split-off point total $46,000 a year. The company allocates these costs to the joint products on the basis of their total sales values at the split-off point. Each product may be sold at the split-off point or processed further. Data concerning these products appear below:

Required:a. What is financial advantage (disadvantage) of processing Product X beyond the split-off point?b. What is financial advantage (disadvantage) of processing Product Y beyond the split-off point?c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Required:a. What is financial advantage (disadvantage) of processing Product X beyond the split-off point?b. What is financial advantage (disadvantage) of processing Product Y beyond the split-off point?c. What is the minimum amount the company should accept for Product X if it is to be sold at the split-off point?d. What is the minimum amount the company should accept for Product Y if it is to be sold at the split-off point?

Correct Answer:

Verified

Correct Answer:

Verified

Q279: The management of Furrow Corporation is considering

Q280: Kirgan, Inc., manufactures a product with the

Q281: Supler Corporation produces a part used in

Q282: A disadvantage of vertical integration is that

Q283: The management of Wengel Corporation is considering

Q285: Fixed costs are sunk costs.

Q286: Twisdale Corporation manufactures numerous products, one of

Q287: In the absorption approach to cost-plus pricing,

Q288: Mercer Corporation estimates that an investment of

Q289: Product X-547 is one of the joint