Multiple Choice

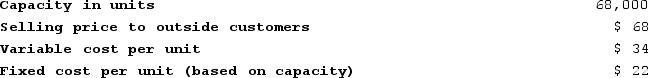

Mittan Products, Incorporated, has a Antennae Division that manufactures and sells a number of products, including a standard antennae that could be used by another division in the company, the Aircraft Products Division, in one of its products. Data concerning that antennae appear below:  The Aircraft Products Division is currently purchasing 4,000 of these antennaes per year from an overseas supplier at a cost of $66 per antennae. Assume that the Valve Division is selling all of the valves it can produce to outside customers. From the standpoint of the Valve Division, what is the lost contribution margin if the valves are transferred internally rather than sold to outside customers?

The Aircraft Products Division is currently purchasing 4,000 of these antennaes per year from an overseas supplier at a cost of $66 per antennae. Assume that the Valve Division is selling all of the valves it can produce to outside customers. From the standpoint of the Valve Division, what is the lost contribution margin if the valves are transferred internally rather than sold to outside customers?

A) $48,000

B) $136,000

C) $2,312,000

D) $152,000

Correct Answer:

Verified

Correct Answer:

Verified

Q197: Robichau Incorporated reported the following results from

Q198: Division P of the Nyers Company makes

Q199: All other things the same, an increase

Q200: Robichau Incorporated reported the following results from

Q201: The Hum Division of the Ho Company

Q203: Residual income should be used to evaluate

Q204: Craycraft Incorporated reported the following results from

Q205: Lakeside Nursing Home has two operating departments,

Q206: Delemos Products, Incorporated has a Transmitter Division

Q207: Wollan Corporation has two operating divisions-an East