Multiple Choice

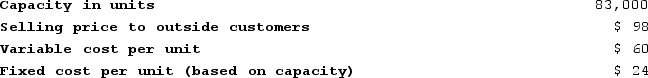

Delemos Products, Incorporated has a Transmitter Division that manufactures and sells a number of products, including a standard transmitter. Data concerning that transmitter appear below:  The Remote Devices Division of Delemos Products, Incorporated needs 6,000 special heavy-duty transmitters per year. The Transmitter Division's variable cost to manufacture and ship this special transmitter would be $66 per unit. Because these special transmitters require more manufacturing resources than the standard transmitter, the Transmitter Division would have to reduce its production and sales of standard transmitters to outside customers from 83,000 units per year to 76,400 units per year. From the standpoint of the Transmitter Division, what is the minimal acceptable transfer price for the special transmitters for the Remote Devices Division?

The Remote Devices Division of Delemos Products, Incorporated needs 6,000 special heavy-duty transmitters per year. The Transmitter Division's variable cost to manufacture and ship this special transmitter would be $66 per unit. Because these special transmitters require more manufacturing resources than the standard transmitter, the Transmitter Division would have to reduce its production and sales of standard transmitters to outside customers from 83,000 units per year to 76,400 units per year. From the standpoint of the Transmitter Division, what is the minimal acceptable transfer price for the special transmitters for the Remote Devices Division?

A) $90.00 per unit

B) $98.00 per unit

C) $104.00 per unit

D) $107.80 per unit

Correct Answer:

Verified

Correct Answer:

Verified

Q201: The Hum Division of the Ho Company

Q202: Mittan Products, Incorporated, has a Antennae Division

Q203: Residual income should be used to evaluate

Q204: Craycraft Incorporated reported the following results from

Q205: Lakeside Nursing Home has two operating departments,

Q207: Wollan Corporation has two operating divisions-an East

Q208: Whenever possible, service department costs should be

Q209: Ricardo Products, Incorporated has a Motor Division

Q210: Zumsteg Products, Incorporated, has a Pump Division

Q211: Setting transfer prices at full cost can