Essay

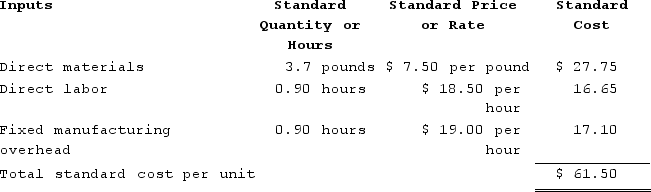

Herriot Corporation manufactures one product. It does not maintain any beginning or ending Work in Process inventories. The company uses a standard cost system in which inventories are recorded at their standard costs and any variances are closed directly to Cost of Goods Sold. There is no variable manufacturing overhead. The standard cost card for the company's only product is as follows:

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $598,500 and budgeted activity of 31,500 hours.

The standard fixed manufacturing overhead rate was based on budgeted fixed manufacturing overhead of $598,500 and budgeted activity of 31,500 hours.

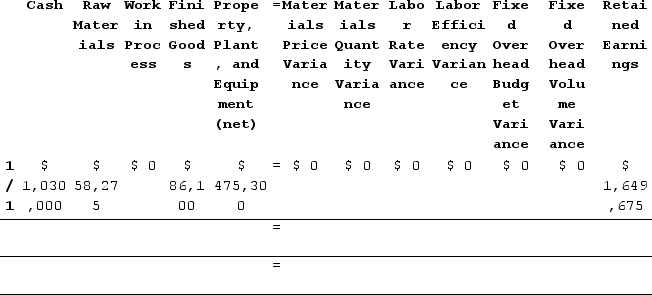

During the year, the company applied fixed overhead to the 37,500 units in work in process inventory using the predetermined overhead rate multiplied by the number of direct labor-hours allowed. Actual fixed overhead costs for the year were $609,000. Of this total, $549,000 related to items such as insurance, utilities, and indirect labor salaries that were all paid in cash and $60,000 related to depreciation of manufacturing equipment.

Required:Completely record the transactions involving fixed overhead, including any variances, in the worksheet that appears below. The beginning balances have been provided for each of the accounts, including the Property, Plant, and Equipment (net) account which is abbreviated as PP&E (net).

Correct Answer:

Verified

Budget variance = Actual fixed overhead ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q84: Cleland Corporation manufactures one product. It does

Q85: The Haney Corporation has a standard costing

Q86: Bumgardner Incorporated has provided the following data

Q87: Bulluck Corporation makes a product with the

Q88: The standard labor rate per hour should

Q90: Bondi Corporation makes automotive engines. For the

Q91: Gipple Corporation makes a product that uses

Q92: Decena Corporation manufactures one product. It does

Q93: Devoto Incorporated has provided the following data

Q94: Wangerin Corporation applies overhead to products based