Essay

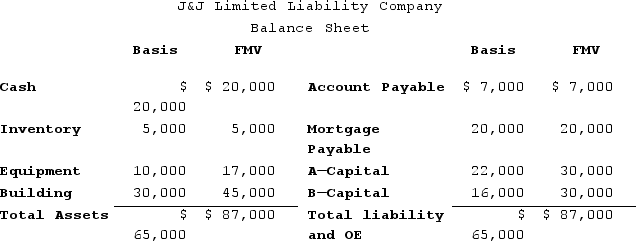

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Correct Answer:

Verified

If member C received a one-third capital...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Adjustments to a partner's outside basis are

Q11: Frank and Bob are equal members in

Q15: Ruby's tax basis in her partnership interest

Q17: Ruby's tax basis in her partnership interest

Q21: Clint noticed that the Schedule K-1 he

Q24: Greg, a 40percent partner in GSS Partnership,

Q66: Tim, a real estate investor, Ken, a

Q73: Which of the following statements regarding the

Q96: What is the difference between a partner's

Q98: How does additional debt or relief of