Essay

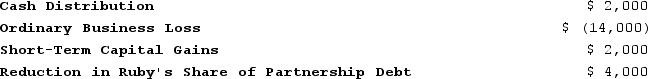

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at-risk amount are equal and that she is a material participant in the partnership's activities. Further, assume that Ruby and her husband, Gerald, are not involved in any other trade or business and that they file a joint return every year.

Correct Answer:

Verified

As shown in the table below, Ruby must f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q1: Adjustments to a partner's outside basis are

Q11: Frank and Bob are equal members in

Q16: J&J, LLC, was in its third year

Q17: Ruby's tax basis in her partnership interest

Q24: Greg, a 40percent partner in GSS Partnership,

Q66: Tim, a real estate investor, Ken, a

Q73: Which of the following statements regarding the

Q92: A purchased partnership interest has a holding

Q96: What is the difference between a partner's

Q98: How does additional debt or relief of