Essay

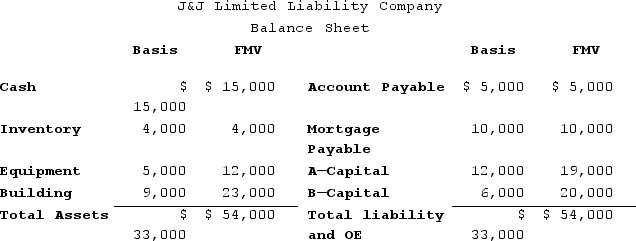

J&J, LLC, was in its third year of operations when J&J decided to expand the number of members from two, A and B, with equal profits and capital interests, to three members, A, B, and C. The third member, C, will contribute her financial expertise to the LLC in exchange for a one-third capital interest in J&J. Given the balance sheet below reflecting the financial position of J&J on the date member C is admitted, what are the tax consequences to members A, B, and C, and to J&J, when C receives her capital interest? If, instead, member C receives a one-third profits interest, what would be the tax consequences to members A, B, and C, and to J&J?

Correct Answer:

Verified

Correct Answer:

Verified

Q3: If a partner participates in partnership activities

Q8: ER General Partnership, a medical supplies business,

Q9: Gerald received a one-third capital and profit

Q11: Frank and Bob are equal members in

Q20: Frank and Bob are equal members in

Q30: On January 1, X9, Gerald received his

Q52: Styling Shoes, LLC, filed its 20X8 Form

Q57: Actual or deemed cash distributions in excess

Q92: A purchased partnership interest has a holding

Q123: Which person would generally be treated as