Multiple Choice

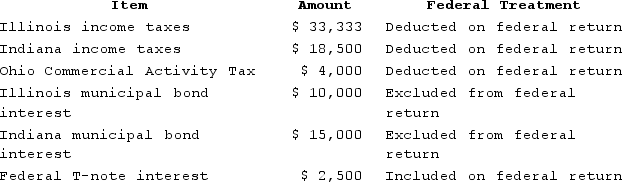

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $100,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

PWD's federal taxable income was $100,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

A) $116,000

B) $130,833

C) $131,000

D) $145,833

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Delivery of tangible personal property through common

Q14: Tennis Pro has the following sales, payroll,

Q20: Tennis Pro, a Virginia corporation domiciled in

Q21: Carolina's Hats has the following sales, payroll,

Q55: Bethesda Corporation is unprotected from income tax

Q59: On which of the following transactions should

Q75: Public Law 86-272 was a congressional response

Q81: Which of the following isn't a criterion

Q106: Which of the following sales is likely

Q117: The Wrigley case held that the sale