Multiple Choice

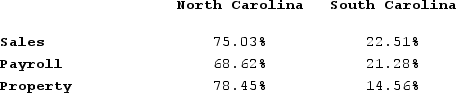

Carolina's Hats has the following sales, payroll, and property factors:  What is Carolina's Hats North and South Carolina apportionment factors if North Carolina uses an equally weighted three-factor formula and South Carolina uses a double-weighted sales factor formula? (Round your answers to two decimal places.)

What is Carolina's Hats North and South Carolina apportionment factors if North Carolina uses an equally weighted three-factor formula and South Carolina uses a double-weighted sales factor formula? (Round your answers to two decimal places.)

A) North Carolina 74.03 percent, and South Carolina 19.45 percent.

B) North Carolina 74.03 percent, and South Carolina 20.22 percent.

C) North Carolina 74.28 percent, and South Carolina 19.45 percent.

D) North Carolina 74.28 percent, and South Carolina 22.51 percent.

Correct Answer:

Verified

Correct Answer:

Verified

Q4: Delivery of tangible personal property through common

Q19: PWD Incorporated is an Illinois corporation. It

Q20: Tennis Pro, a Virginia corporation domiciled in

Q25: Della Corporation is headquartered in Carlisle, Pennsylvania.

Q55: Bethesda Corporation is unprotected from income tax

Q59: On which of the following transactions should

Q61: Rental income is allocated to the state

Q81: Which of the following isn't a criterion

Q106: Which of the following sales is likely

Q117: The Wrigley case held that the sale