Multiple Choice

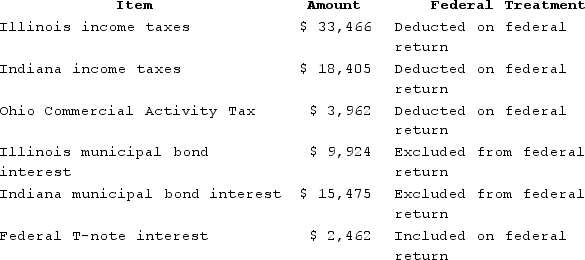

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $119,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

PWD's federal taxable income was $119,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

A) $134,943

B) $149,447

C) $150,418

D) $165,479

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Tennis Pro is headquartered in Virginia. Assume

Q10: Gordon operates the Tennis Pro Shop in

Q12: Super Sadie, Incorporated, manufactures sandals and distributes

Q13: Moss Incorporated is a Washington corporation. It

Q14: Tennis Pro has the following sales, payroll,

Q43: Mighty Manny, Incorporated manufactures ice scrapers and

Q93: The Wayfair decision held that an out-of-state

Q97: Separate-return states require each member of a

Q99: Roxy operates a dress shop in Arlington,

Q114: Which of the following isn't a requirement