Essay

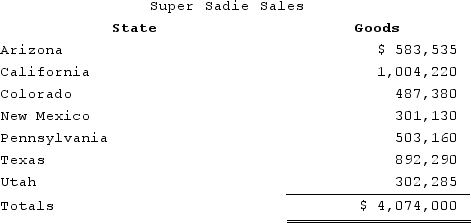

Super Sadie, Incorporated, manufactures sandals and distributes them across the southwestern United States. Assume that Super Sadie has sales tax nexus in Arizona, California, Colorado, New Mexico, and Texas. Super Sadie has sales as follows:

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Pennsylvania (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Assume the following sales tax rates: Arizona (6 percent), California (8 percent), Colorado (7 percent), New Mexico (6.5 percent), Pennsylvania (7.25 percent), Texas (8 percent), and Utah (5 percent). What is Super Sadie's total sales and use tax liability? (Round your interim calculations to the nearest whole number.)

Correct Answer:

Verified

${{[a(23)]:#,###}}.

(${{[a(1)]...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

(${{[a(1)]...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Tennis Pro is headquartered in Virginia. Assume

Q9: PWD Incorporated is an Illinois corporation. It

Q10: Gordon operates the Tennis Pro Shop in

Q13: Moss Incorporated is a Washington corporation. It

Q14: Tennis Pro has the following sales, payroll,

Q59: On which of the following transactions should

Q75: Public Law 86-272 was a congressional response

Q81: Which of the following isn't a criterion

Q93: The Wayfair decision held that an out-of-state

Q114: Which of the following isn't a requirement