Essay

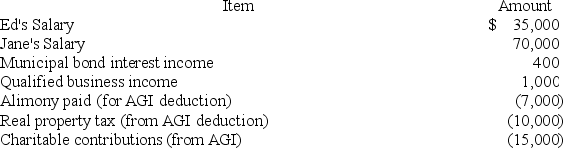

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What is the couple's gross income?

Correct Answer:

Verified

$106,000, ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q10: Which of the following statements regarding tax

Q11: A taxpayer may qualify for the head

Q12: Joanna received $60,000 compensation from her employer,

Q13: Sally received $60,000 of compensation from her

Q14: The standard deduction amount for married filing

Q16: The income tax base for an individual

Q17: In June of year 1, Eric's wife

Q18: Jane and Ed Rochester are married with

Q19: To determine filing status, a taxpayer's marital

Q20: The Inouyes filed jointly in 2018. Their