Essay

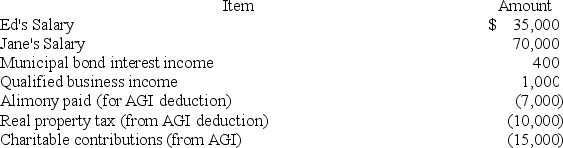

Jane and Ed Rochester are married with a two-year-old child who lives with them and whom they support financially. In 2018, Ed and Jane realized the following items of income and expense:

They also qualified for a $2,000 child tax credit. Their employers withheld $5,800 in federal income taxes from their paychecks (in the aggregate). Finally, the 2018 standard deduction amount for MFJ taxpayers is $24,000.

What are the couple's taxes due or tax refund (use the tax rate schedules not tax tables)?

Correct Answer:

Verified

$675 tax d...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q13: Sally received $60,000 of compensation from her

Q14: The standard deduction amount for married filing

Q15: Jane and Ed Rochester are married with

Q16: The income tax base for an individual

Q17: In June of year 1, Eric's wife

Q19: To determine filing status, a taxpayer's marital

Q20: The Inouyes filed jointly in 2018. Their

Q21: When determining whether a child meets the

Q22: Taxpayers are generally allowed to claim deductions

Q23: A personal automobile is a capital asset.