Essay

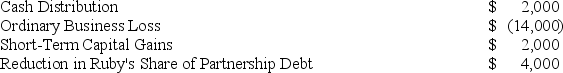

Ruby's tax basis in her partnership interest at the beginning of the partnership's tax year was $13,000. The following items were included in her Schedule K-1 from the partnership for the year:

Determine what amounts related to these items Ruby will report on her tax return assuming her tax basis and at risk amount are equal and that she is a material participant in the partnership's activities.

Correct Answer:

Verified

As shown in the table below, Ruby must f...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Jay has a tax basis of $14,000

Q28: Lloyd and Harry, equal partners, form the

Q30: Which of the following statements regarding partnerships

Q34: Peter, Matt, Priscilla, and Mary began the

Q35: If a taxpayer sells a passive activity

Q70: Which of the following would not be

Q83: Under general circumstances, debt is allocated from

Q96: What is the difference between a partner's

Q105: Tom is talking to his friend Bob,

Q112: Tax elections are rarely made at the