Essay

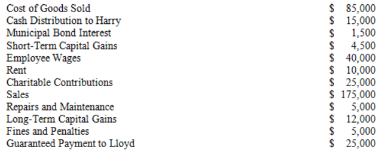

Lloyd and Harry, equal partners, form the Ant World Partnership. During the year, Ant World had the following revenue, expenses, gains, losses, and distributions:

Given these items, what amount of ordinary business income (loss) and what separately-stated items should be allocated to each partner for the year?

Correct Answer:

Verified

The amount of ordinary busines...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Jay has a tax basis of $14,000

Q25: Alfred, a one-third profits and capital partner

Q26: On 12/31/X4, Zoom, LLC reported a $60,000

Q30: Which of the following statements regarding partnerships

Q33: Ruby's tax basis in her partnership interest

Q67: A partner can generally apply passive activity

Q70: Which of the following would not be

Q71: What is the rationale for the specific

Q96: What is the difference between a partner's

Q116: Why are guaranteed payments deducted in calculating