Essay

Alfred, a one-third profits and capital partner in Pizzeria Partnership needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for years 1 and 2.

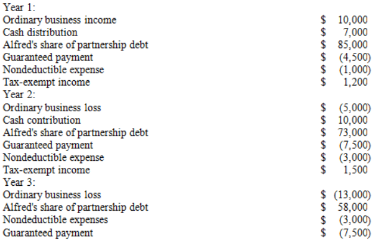

Using the following information from Alfred's year 1, year 2, and year 3 Schedule K-1, calculate his tax basis the end of year 2 and year 3.

Correct Answer:

Verified

At the end of year 2, Alfred's basis is ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: If partnership debt is reduced and a

Q21: A partner's self-employment earnings (loss) may be

Q25: Which of the following does not represent

Q26: On 12/31/X4, Zoom, LLC reported a $60,000

Q28: Lloyd and Harry, equal partners, form the

Q30: Which of the following statements regarding partnerships

Q67: A partner can generally apply passive activity

Q71: What is the rationale for the specific

Q96: What is the difference between a partner's

Q116: Why are guaranteed payments deducted in calculating