Essay

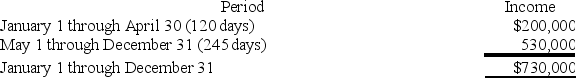

ABC was formed as a calendar-year S corporation with Alan, Brenda and Conner as equal shareholders. On May 1, 2018, ABC's S election was terminated after Conner sold his ABC shares (one-third of all shares) to his solely owned C corporation Conner, Inc. ABC reported business income for 2018 as follows (assume that there are 365 days in the year):

If ABC uses the specific identification method to allocate income, how much will it allocate to the S corporation short year and C corporation short year?

Correct Answer:

Verified

S corporation short ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: C corporations that elect S corporation status

Q45: The specific identification method is a method

Q59: Which of the following is the correct

Q61: Suppose Clampett, Inc. terminated its S election

Q65: RGD Corporation was a C corporation from

Q66: Which of the following is not a

Q69: During 2018, CDE Corporation (an S corporation

Q86: For an S corporation shareholder to deduct

Q88: Maria, a resident of Mexico City, Mexico,

Q148: The S corporation rules are less complex