Essay

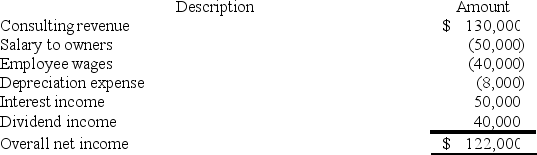

RGD Corporation was a C corporation from its inception in 2014 through 2017. However, it elected S corporation status effective January 1, 2018. RGD had $50,000 of earnings and profits at the end of 2017. RGD reported the following information for its 2018 tax year.

What amount of excess net passive income tax is RGD liable for in 2018? (Round your answer for excess net passive income to the nearest thousand).

Correct Answer:

Verified

$7,350 (21% × $35,000). Passive investme...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: C corporations that elect S corporation status

Q45: The specific identification method is a method

Q61: Suppose Clampett, Inc. terminated its S election

Q64: ABC was formed as a calendar-year S

Q66: Which of the following is not a

Q69: During 2018, CDE Corporation (an S corporation

Q70: Unlike partnerships, adjustments that decrease an S

Q86: For an S corporation shareholder to deduct

Q88: Maria, a resident of Mexico City, Mexico,

Q148: The S corporation rules are less complex