Multiple Choice

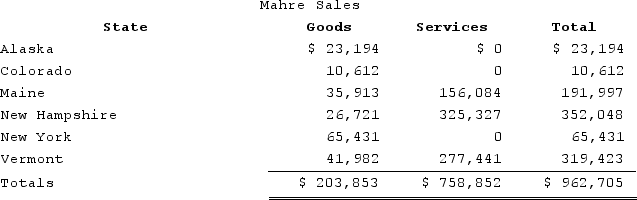

Mahre, Incorporated, a New York corporation, runs ski tours in several states. Mahre also has a New York retail store and an Internet store, which ships to out-of-state customers. The ski tours operate in Maine, New Hampshire, and Vermont, where Mahre has employees and owns and uses tangible personal property. Mahre has real property only in New York. Mahre has the following sales:  Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit in Maine?

Assume the following sales tax rates: Alaska (0 percent) , Colorado (7.75 percent) , Maine (8.5 percent) , New Hampshire (6.75 percent) , New York (8 percent) , and Vermont (5 percent) . How much sales and use tax must Mahre collect and remit in Maine?

A) $0

B) $3,053

C) $13,267

D) $16,319

Correct Answer:

Verified

Correct Answer:

Verified

Q7: Interest and dividends are allocated to the

Q23: Moss Incorporated is a Washington corporation. It

Q24: Big Company and Little Company are both

Q25: Wacky Wendy produces gourmet cheese in Wisconsin.

Q26: The Wayfair decision reversed the Quill decision,

Q33: Assume Tennis Pro discovered that one salesperson

Q88: Businesses must collect sales tax only in

Q97: Separate-return states require each member of a

Q114: Which of the following isn't a requirement

Q132: Most states have shifted away from an