Short Answer

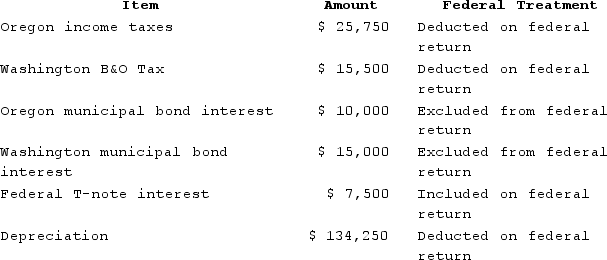

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,500. Moss's federal taxable income was $549,743. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,500. Moss's federal taxable income was $549,743. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Correct Answer:

Verified

$581,743.

$549,743 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

$549,743 +...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q18: Wacky Wendy produces gourmet cheese in Wisconsin.

Q24: Mahre, Incorporated, a New York corporation, runs

Q24: Big Company and Little Company are both

Q25: Wacky Wendy produces gourmet cheese in Wisconsin.

Q26: The Wayfair decision reversed the Quill decision,

Q33: Assume Tennis Pro discovered that one salesperson

Q88: Businesses must collect sales tax only in

Q97: Separate-return states require each member of a

Q114: Which of the following isn't a requirement

Q132: Most states have shifted away from an