Multiple Choice

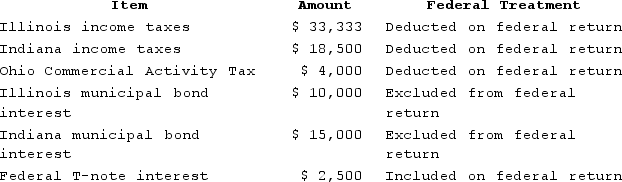

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $100,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

PWD's federal taxable income was $100,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

A) $116,000

B) $130,833

C) $131,000

D) $145,833

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Use tax liability accrues in the state

Q14: Most state tax laws adopt the federal

Q27: What was the Supreme Court's holding in

Q45: Gordon operates the Tennis Pro Shop in

Q50: Several states are now moving from a

Q64: Which of the following is not a

Q67: PWD Incorporated is an Illinois corporation. It

Q68: Mahre, Incorporated, a New York corporation, runs

Q105: In recent years, states are weighting the

Q119: A state's apportionment formula usually is applied