Multiple Choice

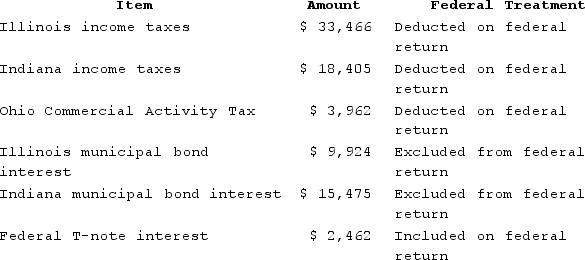

PWD Incorporated is an Illinois corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:  PWD's federal taxable income was $119,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

PWD's federal taxable income was $119,000. If Illinois only requires Illinois taxes to be added back, calculate PWD's Illinois state tax base.

A) $134,943

B) $149,447

C) $150,418

D) $165,479

Correct Answer:

Verified

Correct Answer:

Verified

Q9: Use tax liability accrues in the state

Q27: What was the Supreme Court's holding in

Q28: State tax law is comprised solely of

Q34: List the steps necessary to determine an

Q45: Gordon operates the Tennis Pro Shop in

Q50: Several states are now moving from a

Q65: PWD Incorporated is an Illinois corporation. It

Q68: Mahre, Incorporated, a New York corporation, runs

Q105: In recent years, states are weighting the

Q119: A state's apportionment formula usually is applied