Multiple Choice

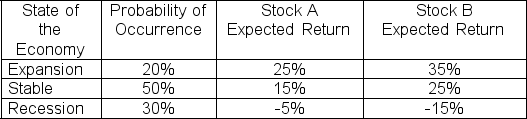

Given the following forecasts for a portfolio that has $1,500 invested in Stock A and $4,500 invested in Stock B, what is the correlation between the two stocks?

A) -0.99

B) 0

C) 0.99

D) -1.00

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q10: Use the following three statements to answer

Q11: Which of the following is NOT a

Q12: What is the expected return on a

Q13: A year ago, you bought some shares

Q14: Non-systematic risk is also called:<br>A)market risk<br>B)unique risk<br>C)total

Q16: You are contemplating investing in two stocks

Q17: On January 1, you forecasted that there

Q18: A share of Oedipus Construction Company was

Q19: What is the correlation between stocks X

Q20: Risk-Return in a Portfolio Question:<br>The following table