Essay

Risk-Return in a Portfolio Question:

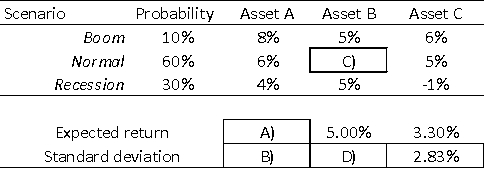

The following table presents some statistics about the returns of three assets, Assets A, B, and C, respectively, under three possible scenarios (Boom, Normal, and Recession).The expected probabilities of each state are also specified in the table.

a)Complete the blanks in the above table.Show your calculations.

b)Suppose you wish to combine Assets A and B in order to create a portfolio that has the same total risk as Asset C.What weight should you invest in Asset A? In Asset B?

Correct Answer:

Verified

a)

A: 5.60% = 10%*8% + 60%*6% + 30%*4%

B...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

A: 5.60% = 10%*8% + 60%*6% + 30%*4%

B...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q15: Given the following forecasts for a portfolio

Q16: You are contemplating investing in two stocks

Q17: On January 1, you forecasted that there

Q18: A share of Oedipus Construction Company was

Q19: What is the correlation between stocks X

Q21: Suppose you own a two-security portfolio.You have

Q22: Which of the following is FALSE regarding

Q23: You have observed the following annual returns

Q24: Steve bought a share of Toronto Skates

Q25: In a two-security portfolio 25% of your