Multiple Choice

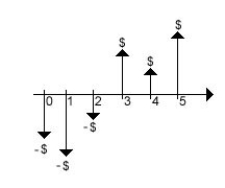

A project is subject to the following cash flow diagram:  What rate of return would it be appropriate to use in this case?

What rate of return would it be appropriate to use in this case?

A) ERR

B) IRR

C) MARR

D) Market rate of return

E) Explicit rate of return

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: What is the major disadvantage of the

Q3: A project involves an immediate expenditure of

Q4: A project requires no initial investment. It

Q5: You are considering the following project: It

Q6: Dealing with mutually exclusive projects, we start

Q7: The fundamental idea behind comparison of mutually

Q8: If you can invest money at 10%

Q9: When does the problem of multiple IRRs

Q10: A two-year project has $100 million as

Q11: The following table summarizes information for five