Multiple Choice

Figure 11-6a

Figure 11-6a

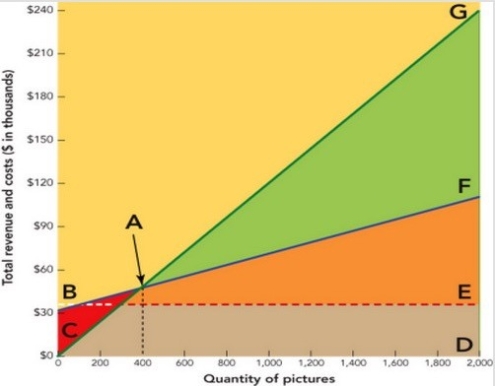

-Suppose you are the owner of a picture frame store and you wish to calculate how many frames you must sell to cover your fixed and variable costs at a given price. Let's assume that the demand for your frames is strong, so the average price customers are willing to pay for each picture frame is $120. Also, suppose your fixed costs (FC) total $32,000 (real estate taxes, interest on a bank loan, etc.) and unit variable cost (UVC) for a picture frame is $40 (labor, glass, frame, and matting) . If your picture frame store sold 2,000 picture frames, what would your profit (or loss) be?

A) −$32,000

B) $0

C) $32,000

D) $112,000

E) $128,000

Correct Answer:

Verified

Correct Answer:

Verified

Q19: Predatory pricing is<br>A) an arrangement a manufacturer

Q52: The break-even point (BEP) = [Fixed cost

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8552/.jpg" alt=" Figure 11-3a -Figure

Q98: All of the following are demand factors

Q151: The vertical axis of a demand curve

Q163: A firm may forgo a higher profit

Q175: Target return-on-investment pricing refers to<br>A) setting a

Q175: The unit variable cost (UVC) equals variable

Q242: Price elasticity of demand measures how sensitive

Q281: The owner of a store that sells