Multiple Choice

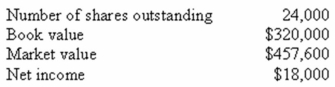

Birds and More is considering a project which requires the purchase of $175,000 of fixed assets.The net present value of the project is $4,500.Equity shares will be issued as the sole means of financing this project.The price-earnings ratio of the project equals that of the existing firm.What will the new market value per share be after the project is implemented given the following current information on the firm?

A) $18.68

B) $18.72

C) $18.80

D) $19.20

E) $21.10

Correct Answer:

Verified

Correct Answer:

Verified

Q11: A.K.Stevenson wants to raise $7.5 million through

Q19: Outdoor Living needs $7.5 million to finance

Q32: Mountain Teas wants to raise $11.6 million

Q40: Kurt currently owns 3.4 percent of Northeastern

Q49: A rights offering in which an underwriting

Q57: High Mountain Mining wants to expand its

Q74: Which of the following have been offered

Q76: Franklin Minerals recently had a rights offering

Q81: It can be argued that the decision

Q93: Soup Galore is a partnership that was