Multiple Choice

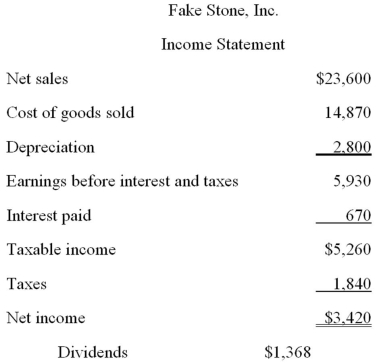

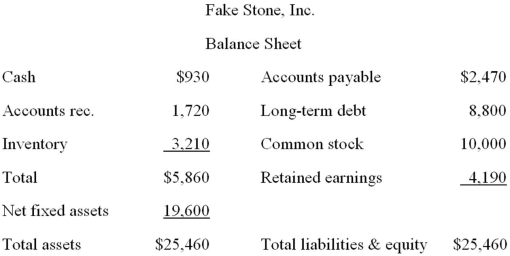

Assume that Fake Stone, Inc.is operating at 88 percent of capacity.All costs and net working capital vary directly with sales.What is the amount of the pro forma net fixed assets for next year if sales are projected to increase by 13 percent?

A) $19,600

B) $20,406

C) $21,500

D) $21,667

E) $22,148

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Financial plans generally tend to ignore which

Q36: Gladsden Refinishers currently has $21,900 in sales

Q47: Phil is working on a financial plan

Q52: The Parodies Corp.has a 22 percent return

Q57: Which one of the following ratios identifies

Q63: A firm has a retention ratio of

Q90: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Assume

Q91: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Hungry

Q97: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" The

Q98: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Fake