Multiple Choice

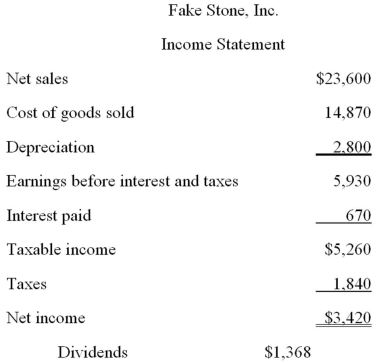

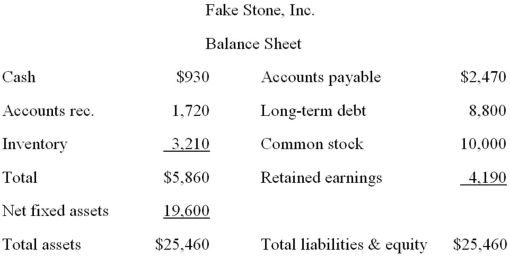

Assume that net working capital and all of the costs of Fake Stone, Inc.increase directly with sales.Also assume that the tax rate and the dividend payout ratio are constant.The firm is currently operating at full capacity.What is the external financing need if sales increase by 4 percent?

A) -$1,214.48

B) -$804.15

C) -$397.19

D) $201.16

E) $525.38

Correct Answer:

Verified

Correct Answer:

Verified

Q36: Gladsden Refinishers currently has $21,900 in sales

Q46: Which of the following questions are appropriate

Q47: Phil is working on a financial plan

Q50: Which one of the following policies most

Q52: The Parodies Corp.has a 22 percent return

Q57: Which one of the following ratios identifies

Q63: A firm has a retention ratio of

Q68: A firm is operating at 90 percent

Q91: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Hungry

Q93: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8406/.jpg" alt=" Assume