Multiple Choice

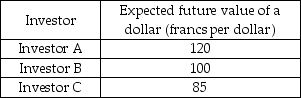

-Using the table above, if the current market value of the dollar is 125 francs

A) investor A holds dollars, but B and C hold francs.

B) investor A holds francs, but B and C hold dollars.

C) all three investors hold francs.

D) all three investors hold dollars.

Correct Answer:

Verified

Correct Answer:

Verified

Q12: With everything else the same, in the

Q13: Suppose the current account of a country

Q14: Suppose Italy currently lends 1.5 billion euros

Q15: When the U.S. exports goods to foreign

Q16: The account that records foreign investment in

Q18: In June 2008, $1 bought 104 yen

Q19: Explain the effect on the demand for

Q20: The United States is a creditor nation.

Q21: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB8586/.jpg" alt=" -The above figure

Q22: If people expect the dollar to depreciate,