Essay

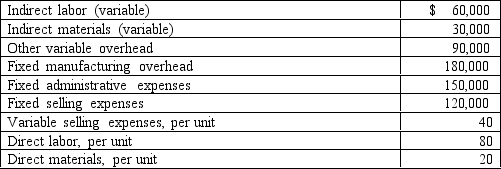

Last year, Baker Company produced 30,000 units and sold 28,000 units. Beginning inventory was zero. During the period, the following costs were incurred:

Required: Compute the dollar amount of ending inventory using:

Required: Compute the dollar amount of ending inventory using:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q26: Which of the following is never included

Q27: All _ expenses will vanish if a

Q34: The _ income statement groups expenses according

Q51: A _ is a subunit of a

Q83: Loring Company had the following data for

Q93: Ramon Company reported the following units of

Q96: Prepare a segmented income statement for Mario

Q99: When the economic order quantity (EOQ) model

Q107: Sanders Company has the following information for

Q233: Variable costing treats fixed factory overhead as