Essay

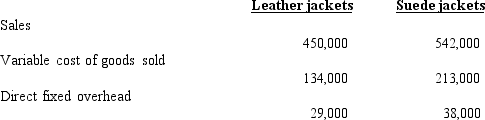

Prepare a segmented income statement for Mario Co. for the coming year, using variable costing.

A sales commission of 2% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets. Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

A sales commission of 2% of sales is paid for each of the two product lines. Direct fixed selling and administrative expense was estimated to be $32,000 for the leather jackets and $66,000 for the suede jackets. Common fixed overhead for the factory was estimated to be $83,000 and common selling and administrative expense was estimated to be $14,000.

Required: Prepare a segmented income statement for Mario Co. for the coming year, using variable costing.

Correct Answer:

Verified

Correct Answer:

Verified

Q26: Which of the following is never included

Q27: All _ expenses will vanish if a

Q34: The _ income statement groups expenses according

Q51: A _ is a subunit of a

Q73: JIT responds to the problems traditionally solved

Q83: Loring Company had the following data for

Q97: Last year, Baker Company produced 30,000 units

Q99: When the economic order quantity (EOQ) model

Q107: Sanders Company has the following information for

Q233: Variable costing treats fixed factory overhead as