Multiple Choice

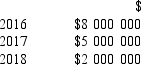

On 1 January 2016, Romulus Ltd signed a contract worth $21 000 000 to construct a light rail from A to B. The light rail was to be built over three years, with progress payments of $7 000 000 to be made at the end of each year. Estimated costs were $15 000 000 and the following costs incurred and paid by Romulus Ltd were in accordance with estimates and represented the percentage completed in each year:  The project was completed in December 2018. Using the completed contract method, how much profit would Romulus Ltd report in 2018?

The project was completed in December 2018. Using the completed contract method, how much profit would Romulus Ltd report in 2018?

A) $800 000

B) $2 000 000

C) $6 000 000

D) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q8: The profit for a particular project of

Q9: Which of the following transactions should not

Q10: Junction Company had the following transactions, among

Q11: Leslie Ltd has found an error in

Q12: With respect to services provided, it is

Q14: The income statement of Berrima Barbed Wire

Q15: On 1 January 2017, Peter Ltd signed

Q16: The percentage of completion profit for a

Q17: Opec Ltd manufactures crystal balls. Transactions for

Q18: Highrise Constructions Ltd had a large three-year