Essay

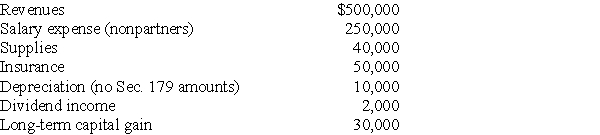

AT Pet Spa is a partnership owned equally by Travis and Ashley. The partnership had the following revenues and expenses this year. Which of the following items are separately stated? Nonseparately stated? What is each partner's distributive share of ordinary income?

Correct Answer:

Verified

Separately-stated items are th...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q79: Identify which of the following statements is

Q80: For a 30% interest in partnership capital,

Q81: George pays $10,000 for a 20% interest

Q82: Ali, a contractor, builds an office building

Q83: Under what conditions will a special allocation

Q85: Nicholas, a 40% partner in Nedeau Partnership,

Q86: Jerry has a 10% interest in the

Q87: The XYZ Partnership reports the following operating

Q88: David purchased a 10% capital and profits

Q89: When determining the guaranteed payment, which of