Multiple Choice

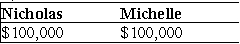

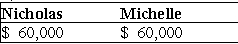

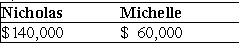

Nicholas, a 40% partner in Nedeau Partnership, gives one-half of his interest to his sister, Michelle. During the current year, Nicholas performs services for the partnership for which reasonable compensation is $80,000, but for which he accepts no pay. Nicholas and Michelle are each credited with a $100,000 distributive share, all of which is ordinary income. What are Nicholas' and Michelle's distributive share?

A)

B)

C)

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q80: For a 30% interest in partnership capital,

Q81: George pays $10,000 for a 20% interest

Q82: Ali, a contractor, builds an office building

Q83: Under what conditions will a special allocation

Q84: AT Pet Spa is a partnership owned

Q86: Jerry has a 10% interest in the

Q87: The XYZ Partnership reports the following operating

Q88: David purchased a 10% capital and profits

Q89: When determining the guaranteed payment, which of

Q90: A partnership has one general partner, Allen,