Multiple Choice

Under a plan of complete liquidation, Key Corporation distributes land (not a disqualified property) with an adjusted basis of $410,000 and an FMV of $300,000 for all Sharon's stock. Sharon's basis in her 5% interest in the Key stock is $250,000. Find Sharon's basis in the land and Key Corporation's recognized gain or loss.

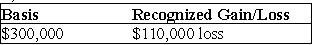

A)

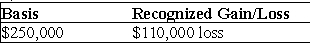

B)

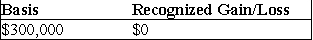

C)

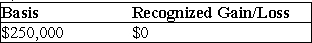

D)

Correct Answer:

Verified

Correct Answer:

Verified

Q44: The adjusted basis of property received in

Q45: Liquidation rules generally are applied the same

Q46: Carly owns 25% of Base Corporation's single

Q47: In a complete liquidation of a corporation,

Q48: Identify which of the following statements is

Q50: Ball Corporation owns 80% of Net Corporation's

Q51: Identify which of the following statements is

Q52: Liquidating expenses are generally deducted as ordinary

Q53: Under the general liquidation rules, Kansas Corporation

Q54: Identify which of the following statements is